Following the recent tribunal ruling in New South Wales of Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue, State Revenue Authorities across Australia have indicated that they intend on increasing investigations into payroll tax non-compliance by General Practitioners (GP). Whilst Revenue Authorities may be targeting GP clinics, these laws also apply to other businesses that engage contractors, including professional consultants and trades people.

Why are GP clinics being targeted

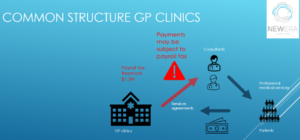

GPs can operate under a variety of different business models. The structure considered in Thomas and Naaz Pty Ltd is a common example. It involves GPs working under a service agreement with a medical practice. In this instance, the medical practice engages receptionists, nurses, and other support staff. The medical practice permits the doctor to access the clinic and medical equipment. The doctor sets the price of patient fees, which the medical practice then collects on behalf of the doctor, and processes Medicare rebates. A fee is then deducted for the use of the facilities of the medical centre, with balance paid to the doctor.

The diagram below illustrates how this arrangement works.

In Thomas and Naaz Pty Ltd, the Tribunal determined that GPs were working in medical centres as contractors, and as a result, the payments made to doctors were taxable wages for the purposes of payroll tax.

What is payroll tax?

Payroll tax is a State-based tax on payments made by an employer when the total amount of wages, superannuation and contractor payments exceeds $1.3 million over a full financial year. Currently, the rate for payroll tax in Queensland is 4.75% for businesses paying $6.5 million or less in taxable wages.

State Revenue Authorities can audit businesses to assess whether they are complying with payroll tax obligations and impose interest and penalties for historical non-compliance. Many GPs are concerned that State Revenue Authorities could be seeking to recover millions of dollars for historical payroll tax non-compliance.

What you should do if you are a GP

The Queensland Office of State Revenue has identified that there is significant lack of awareness of payroll tax obligations by GPs and has granted GPs an amnesty until 30 June 2025.

The deadline for GPs to register for the payroll tax amnesty is Friday, 10 November 2023. Please ensure that you register your interest via the link below to avoid penalties applying to non-conforming structures.

Other arrangements

Not all arrangements are subject to payroll tax. You should seek advice from a professional adviser on whether payments made to your contractors might be subject to payroll tax.

There are alternative compliant arrangements that medical professionals can deploy to avoid the application of payroll tax. One such arrangement is shown below.

Book in and see us

Book in and see us today for a free consultation to assess whether your structure is payroll tax compliant.