Protecting the family home – Gift and loan back arrangement

Many business owners personally hold real property in their own name. The principal place of residence capital gains tax (CGT) exemption often drives the decision to have the family home held by individuals.

The downside to this arrangement is that if an individual is faced with bankruptcy, they could lose their family home and other assets held personally. Transferring real property to other legal entities will trigger stamp duty and potentially CGT, so often a restructure is not a commercially feasible solution.

Many smart couples decide that only one of them should hold the family home in their name. This frees up the other partner to undertake entrepreneurial activities, knowing that the family home is in safe hands.

But often a client will come to us seeking asset protection strategies in a scenario where they are the director of a company and they hold the family home with their spouse as joint tenants or even tenants in common. Alternatively, the client may be single or for other reasons is the sole legal owner of the property. There is a practical and cost effective solution to achieving asset protection for these clients which protects the equity in their home. It involves implementing a gift and loan back arrangement.

How does it work?

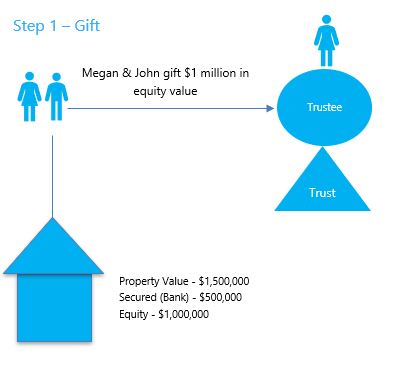

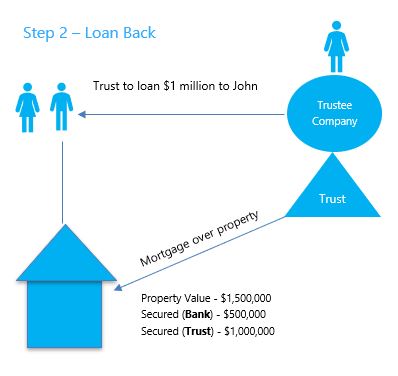

The equitable value of the property is first gifted by the individual to a trust. The trust then lends the equitable value amount back to the individual and secures the loan via registered mortgage over the property. As a result, the trust will have priority over unsecured creditors for the equitable value of the property – meaning that generally these creditors will not be able to force you to sell your family home.

Example

Megan and John have been married for three years. John is the director of a construction company. John understands that he is potentially exposed to personal liabilities from his company’s business activities, which include but are not limited to tax liabilities, WH&S penalties and breaches of directors’ duties.

Megan and John hold their family home as joint tenants. Their home is valued at $1,500,000 and a bank holds a registered mortgage over the home securing the current balance of their home loan which is $500,000.

No cash payments required

No cash changes hands in the above transactions. The loan is notionally repaid to the trust once the property has been sold, with the funds then being distributed to beneficiaries of the trust or to a company.

What if my property increases in value?

The secured equity cannot exceed the unencumbered value of the property which is gifted. However, any increase in the property’s value can by secured by additional gift and loan back arrangements.

What about tax liabilities or transfer duty?

The arrangement achieves the same asset protection as the transferring of an asset, however under this arrangement, stamp duty and CGT does not apply as the legal ownership of the property has not changed.

Can the transaction be clawed back in Bankruptcy?

This arrangement could be subject to the clawback provisions contained in the Bankruptcy Act so it is recommended that this arrangement be implemented as a pre-insolvency strategy.

If you would like further information in relation to this arrangement, please do not hesitate to contact us.